WASHINGTON — While the first quarter of the 2026 fiscal year produced record results on several fronts, equipment constraints and major capital projects are likely to make the second quarter a challenge, Amtrak’s board of directors was told during its meeting today (Wednesday, Jan. 28).

Ongoing issues with the delivery of NextGen Acelas also continue to impact the company on a number of fronts, the board was told during the publicly streamed portion of the meeting.

Chief Financial Officer Costin Corneanu told the board first-quarter ridership was up 422,000 over the same period a year earlier, a 4.7% increase and 49,000 riders ahead of the company’s plan. Those gains came across all three service lines, with the Northeast Corridor showing a gain of 294,000, or 7.6%; state-supported service up by 95,000, or 2.4%, and long-distance up by 33,000, or 2.8%.

Operating results, however, showed a loss of $74.6 million, compared to $68 million in the first quarter of fiscal 2025. Corneanu said the Northeast Corridor remains “operationally profitable,” showing an increase of $13.7 million compared to the same period a year earlier.

Losses for state-supported operations increased by $14.2 million, or 26.4%. Decreased capacity, reflecting the loss of the Horizon car fleet, was a factor, as were higher expenses. Even with the decreased fleet, ticket revenue increased by 0.8%.

Long-distance results saw an improvement of $14.3 million year-over-year, or 9.9%. A combination of a slight increase in capacity and per-ticket yield led to a 17.4% gain in revenue.

“There is a combination of two factors here,” Corneanu said, responding to a question from board member Ellen Clegg. “One is clearly a strong revenue performance, especially on the sleeper; we actually have a good demand on the coach side, too, on the long-distance network, and that has driven the majority of the revenue and ridership improvement from a year-over-year base perspective.

“In addition to that, we’ve also been very focused on capacity in an effective way. So we can see the unit’s cost increases have been very well managed as we have grown capacity.”

Added Chief Commercial Officer Eliot Hamlisch, “a direct answer to your question is more riders traveling further paying more. So all three of those stats are up for [long-distance].”

Hamlisch cautioned that challenges will make it difficult to maintain the first-quarter results.

“Equipment delays and major infrastructure outages will continue to put downward pressure on the business throughout the rest of the year,” he said, “and we remain very steadfastly focused on mitigating those to the greatest extent possible.”

Acela update

While Hamlisch said the Northeast Corridor “continues to outperform the rest of the network,” he noted that came despite limited fleet availability. Delays in the rollout of the NextGen Acela fleet are constraining capacity and the ability to meet demand, as are the reliability issues for the legacy Acela fleet. Those trainsets, which began entering service in 2000, are now well past their projected retirement date, but are expected to be retired by year’s end.

In discussing customer satisfaction data, Hamlisch said the NextGen equipment “has brought significant enhancements to the onboard customer experience, such as better WiFi connectivity, grab-and-go café food service, and newer, cleaner train interiors. That said, customers are still acclimating to the new train layout, including wayfinding, navigation more broadly, and amenities.”

Chief Operating Officer Gery Williams said on-time performance for the Acelas was down 7% in December from the previous year.

“We now have eight NextGen trainsets in service, which represent half of the total active high-speed fleet,” Williams said, adding that the company is battling “infancy issues” with the new equipment.

“One of the major issues has been the reliability of the doors,” he said. “Alstom identified the need to recalibrate some of the door settings as the carbodies settle. Progress is being made. However, it’s been slower than we would like, and that is due to the difficulty in taking the trains out of service long enough for Alstom to do the lengthy calibration work. As we take delivery of more trainsets, the additional capacity will give us more flexibility to complete this work and other work to get us to a more steady state.”

Project outages

Along with the Acela questions, NEC operations will face disruptions from major capital projects, most notably the Penn Access project and the first phase of cutover of the new Portal North Bridge.

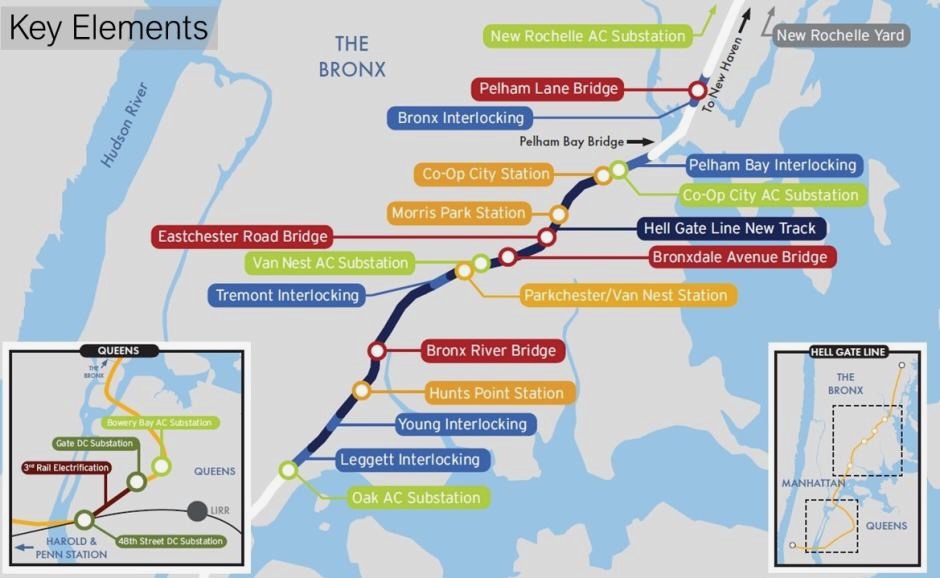

Already in progress is the Penn Access work, which involves adding capacity for Metro-North Railroad service into Penn Station via Amtrak’s Hell Gate Line. The outage that began Jan. 5 and is slated to run through March 30 involves a bridge replacement and will lead to about a 20% reduction in Amtrak service.

Laura Mason, executive vice president of capital delivery, said the project is “a double block, meaning we are going through an interlocking, taking out two blocks of track, making for a very long single track. … This is a big, big impact. Further outages will be expected roughly mid-May to mid-November. We continue to work with a contractor to minimize those outages and ensure that we are using any track time that we take as productively as possible to balance delivering this project with ensuring we can still provide service for the Northeast Corridor.”

The Portal North cutover will move operations onto one track of the two-track bridge over the Hackensack River, but will require a 50% reduction in trains between Newark and Secaucus, N.J., between Feb. 13 and March 16, Mason said. [Previous reports had the dates as Feb. 15 to March 14; see “Portal Bridge cutover …,” Trains.com, Jan. 15, 2026.]

“When we come out of that, we will have the south or westbound track operating on the new Portal North Bridge, that high, fixed bridge not needing to open for any maritime traffic,” Mason said. “… This is a very impactful outage as it takes one of our busiest sections of the corridor down to one track.”

— To report news or errors, contact trainsnewswire@firecrown.com.

As far as food svc I think the dysfunctional mentality among Amtrak mgmt is that by just allowing sleeper patrons to use the diner they only need to stock meals & staff to accommodate that limited clientele, more coach customers would require more meals to stock & god forbid more staff! I had hoped some of the new Board members would have some insight & a spine to address the LD issues but apparently Amtrak mgmt has coerced them to not rock the boat.

Forgive me, but when current Amtrak “management” (mismanagement) speaks all I hear is “wah, wah, wah.”

As many commenting noted, zip on repairing damaged equipment, zip on improving L-D trains, pretty much zip on anything other than the NE Corridor.

As I’ve been saying, use up those Loyalty Points before all the L-D trains are sidelined.

As usual, no apparent outline to the Board of any efforts to increase capacity of all long-distance trains by refurbishing stored/damaged Viewliners and Superliners, sitting at Beech Grove. No totals given of cars having been refurbished and put into service. No totals of cars currently being overhauled. No totals given of cars remaining in storage and awaiting repair.

.

Multiple videos, from drones flying over Beech Grove, show dozens of Viewliners and Superliners sitting idle that could be generating revenue if put into service. New Viewliner Diners sitting unused, when they could be added to the CARDINAL (only long-distance Eastern train without a Diner) to upgrade onboard food service. Damaged Superliner Diners, Lounges and Coaches, that could be added to the CITY OF NEW ORLEANS, TEXAS EAGLE and other Western trains, are just parked and ignored, in repeated videos filmed months and years apart.

.

No mention made of plans to restore Dining Car access by coach passengers on long-distance trains. Currently, most long-distance trains PROHIBIT coach customers from accessing Dining Cars. Their only option is limited food in Lounge Cars. ALL passengers should be allowed to eat regular meals in Diners, thereby improving the on-board experience and generating more repeat customers. Amtrak management continues to be laser-focused on the NEC and on Regional and State-Supported trains, as is clearly evident by every presentation to the Board of Directors. The only attention to long-distance trains is to continue to raise fares and squeeze every dollar possible out of the few passengers that are served.

On the face of it I can’t make any sense out of the policy of keeping coach passengers out of the diners. It is known that dining cars bleed money, as customers are only paying for the meal, not the cost of the railroad buying and running the rolling stock. Wouldn’t more people buying meals help the bottom line?

Could someone please address what I think is a simple question from a non-financial person?

This is a report of the 1st quarter of 2026. How can you report the 1st quarter when we are only near the end of the first month of the quarter?

I know this makes sense for most of you, but it doesn’t for me. Someone please educate me?

The “Fiscal Year” starts in October for Amtrak and most government agencies. So Oct-Nov-Dec is Q1. (Interestingly, my company’s fiscal year starts in November). I’m not sure why it starts in October. Given the amount of last-minute work required at the end of the year, I think it does make some sense that it doesn’t start in January, when everyone is out for the winter holidays.

Thank you !

“We now have eight NextGen trainsets in service, which represent half of the total active high-speed fleet,” Williams said, adding that the company is battling “infancy issues” with the new equipment.

Given that several Acela Next Gen trainsets were built/delivered/stored 3-4 years ago, they’re hardly infants! It’s too bad more of these “infancy issues” weren’t addressed starting in 2023.

NEC “operationally profitable”, now add the costs of maintaining the antiquated physical plant = NEC unprofitable! Pouring this much $$$ into a corridor that is already saturated with competing transportation options while reneging on investing in those regions which have little or no other transportation alternatives. In addition to the fact that NEC states don’t have the same financial obligation (PRIIA) that other states have to pony up to operate their corridor(s).

8 AX-2s and 8 AX-1s seems to be an early days of Acelas Amtrak’s plans in early 2000s. That door problem seems to be a vexing reoccurrence. If 2 – 4 more NGs can enter service without having to retire any AX-1s then reliability of Acelas service will improve. This statement is troubling.

“Alstom identified the need to recalibrate some of the door settings as the carbodies settle.”

How many times will each train set need this recalibration? Also, will that recalibration be for all doors at once or piecemeal on each train set? Let us hope that does not mean several years of recalibration?

The “Penn Access” project is IMHO a winner.

Coop City opened in 1968. That’s over 57 years to “win” fixed rail transit. Better to “win” 57 years late, than never.

Penn Station Access, Portal Bridge replacement, LIRR access to GCT, Empire Trains access to Penn Station, Moynihan Train Hall, JFK Aerotrain, LIRR track expansion in Nassau County, Second Avenue Subway. Much of this has taken too much time, and it adds up to less than what’s needed —- but it’s not as if nothing gets done.